Sound Financial Consulting

Meet Our Team

Our goal is to educate our clients on what different options are available and to form a plan for one's financial future. We look at each client's entire financial spectrum; current cash flow, protection components, debt, retirement and legacy planning, to create an entire package for each client. Meanwhile, we're providing exceptional customer service. Our clients are our first priority.

A Passion for Community

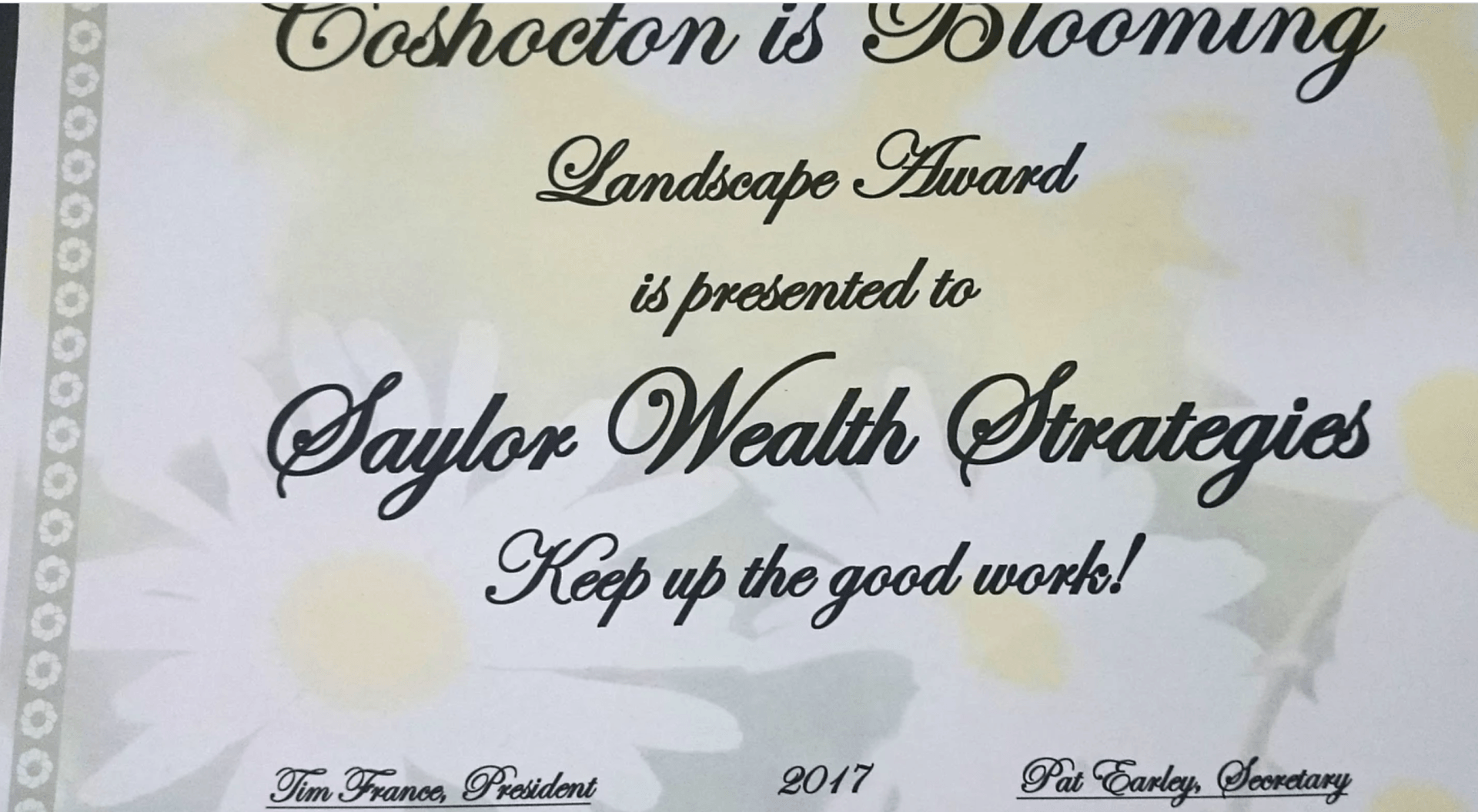

And with help from his wife, Melissa, his charming freestanding building on Walnut Street in downtown Coshocton won a Best Landscaping Award in the Coshocton is Blooming competition.